In an era where digital news publishers rely heavily on social media giants to amplify their content, a seismic shift in the online landscape has occurred, with Silicon Valley distancing itself from news. Recent developments, as reported in The New York Times, have raised concerns about the future of the relationship between news publishers and tech platforms, leaving the digital news industry in a state of turmoil. This blog aims to shed light on the repercussions of this shift for digital news publishers and explores potential solutions to mitigate the challenges they now face.

The age-old relationship between social media platforms and news publishers

For over a decade, social media platforms like Facebook, Twitter (now X) and Instagram played a pivotal role in the digital news ecosystem. They served as a source of substantial traffic, making e-advertising a viable business model for news publishers. This symbiotic relationship offered news publishers a lifeline, bringing their content to a global audience and driving advertising revenue.

However, recent events have sent shockwaves through the industry. Facebook's top news executive, Campbell Brown, announced her departure, while X removed headlines from its platform. Instagram's Threads app also made it clear that it would no longer amplify news. Even Google, traditionally a strong partner for news organizations, has become less dependable.

Back in 2019, Facebook and X used to be pioneers of embracing the power of journalism. Facebook News was a testament to it as readers could find news coverage from partner publications paid for by the tech giant. Similarly, Twitter also aimed at addressing misinformation by partnering with Reuters and The Associated press in 2021 in a bold, yet profitable move.

How will this move impact news publishers?

The ramifications of these changes are significant. Digital news publishers now face a daunting challenge as the traffic that once flowed from these platforms dwindles. According to Similarweb, top news sites in the United States received approximately 11.5% of their web traffic from social networks in September 2020. Fast forward to September 2021, and that figure had dropped to 6.5%. The disruption to the already challenging e-advertising business model is real, and publishers are feeling the pinch.

The decline in social media traffic has been more severe than anticipated, leaving publishers to confront a "post-social web." With the major tech companies distancing themselves from news, many publishers are uncertain whether the traffic they once enjoyed will ever return to previous levels.

Additionally, it may impact publishers in the following manner

- Decreased Advertising Revenue: The decline in social media traffic directly translates to reduced advertising revenue for news publishers. With fewer users accessing their content through social media channels, publishers may lose a significant portion of their audience, which advertisers may target. This can result in lower ad impressions, fewer clicks, and diminished revenue, directly affecting their e-advertising income.

- Increased Competition for Limited Ad Inventory: As news publishers seek alternative sources of traffic, they enter a competitive landscape for limited ad inventory. This increased competition can lead to higher advertising costs, making it more challenging for publishers to maintain profitable e-advertising campaigns. Advertisers may also become more selective in choosing where to allocate their budgets, putting additional pressure on publishers to demonstrate the value of their audiences.

- Impacts on Ad Quality and Relevance: With social media platforms distancing themselves from news, publishers may struggle to maintain the same level of ad quality and relevance. Social media platforms use extensive user data to target ads effectively, but when this data is no longer readily available, publishers might find it challenging to provide advertisers with the same level of audience targeting precision. This can result in less effective advertising campaigns and potentially lead to advertisers questioning the value of their investments with publishers.

What are the solutions to overcome the same?

Given this looming threat, digital news publishers need to diversify their traffic sources to survive. Intermediate platforms like SmartNews, Apple News, and Flipboard are becoming increasingly important as readers seek a mix of authoritative journalism and multiple sources. These platforms offer an alternative to the postapocalyptic wasteland of social media traffic.

Additionally, publishers are becoming more reliant on Google, a platform they have traditionally optimized their content for. Google remains a significant source of referral traffic, but even this is becoming shaky. Some publishers have recently witnessed declines in Google referral traffic, and concerns about future declines persist. To prepare for a post-Google traffic landscape, publishers are exploring new strategies, such as branded newsletters, strengthening their homepages, and promoting their print magazines.

Is there a vulnerability to ad fraud?

As digital news publishers explore new avenues to compensate for the loss of social media traffic, the risk of fraudulent traffic in e-advertising becomes more pronounced. Affiliates play a crucial role in driving traffic to publisher websites. When publishers become more reliant on affiliate marketing to bolster their traffic, they inadvertently open the door to potential fraud.

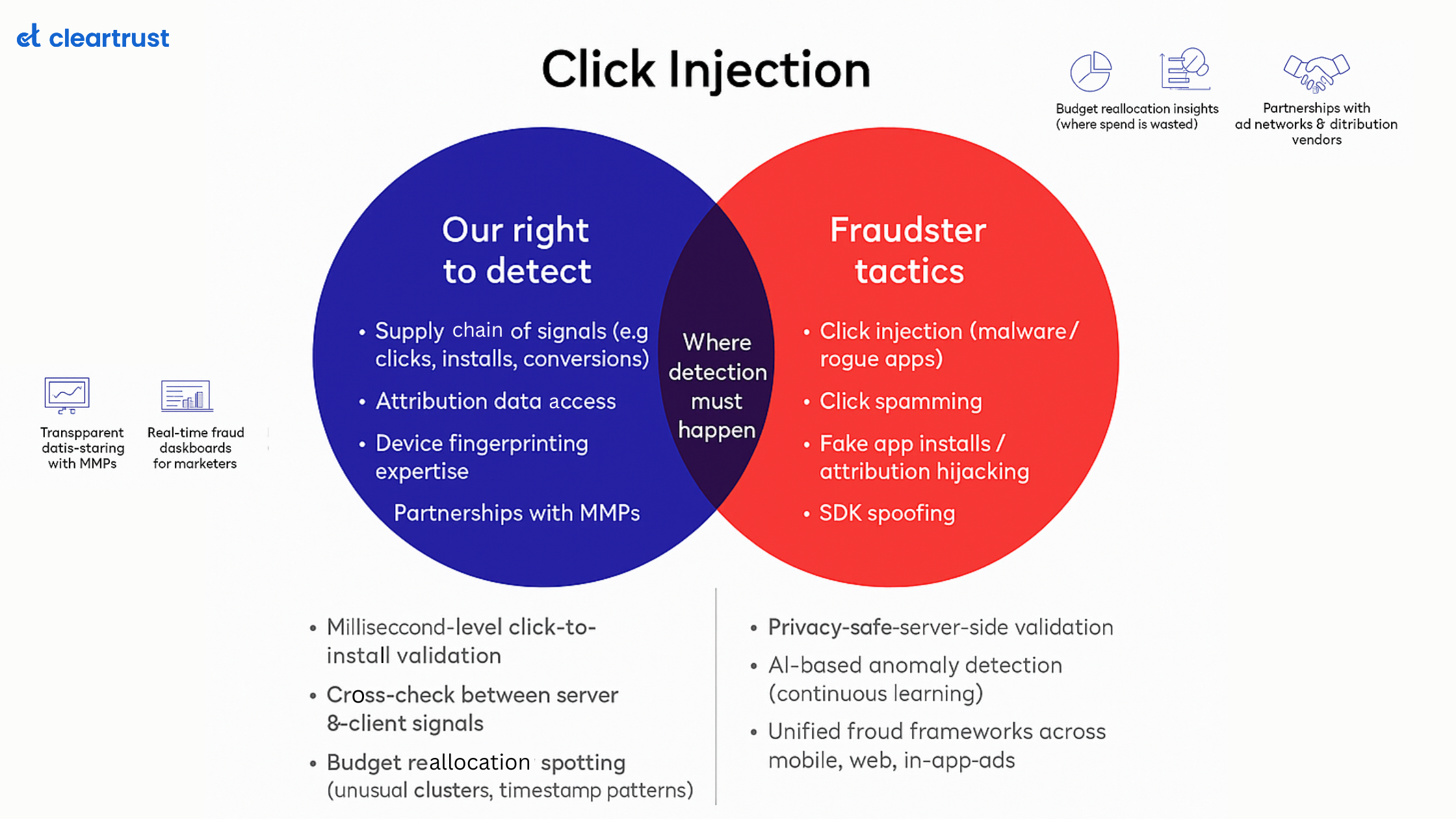

Unscrupulous affiliates might resort to black-hat tactics, such as click fraud or traffic generation through bot networks, to increase referral numbers artificially. This not only inflates the publisher's costs but also undermines the integrity of their advertising metrics. In the absence of a robust system for monitoring and filtering fraudulent traffic, publishers may find it challenging to distinguish genuine visitors from fraudulent ones.

Conclusion

The digital news publishing industry is at a crossroads. The estrangement of social media giants from news amplification has created a challenging environment for publishers, forcing them to reconsider their e-advertising strategies. While diversifying traffic sources and optimizing their content for other platforms is crucial, publishers must also remain vigilant against the rising risk of fraudulent traffic through affiliate marketing.

To counter such risks, looking at ad fraud management solutions is a viable option. Through seamless integration and serving as a one-stop solution to protect against ad fraud vulnerabilities, brands like ClearTrust can help publishers survive with better credibility.